Some Known Factual Statements About Hard Money Atlanta

Wiki Article

What Does Hard Money Atlanta Do?

Table of ContentsEverything about Hard Money AtlantaUnknown Facts About Hard Money AtlantaFacts About Hard Money Atlanta UncoveredThe smart Trick of Hard Money Atlanta That Nobody is Discussing

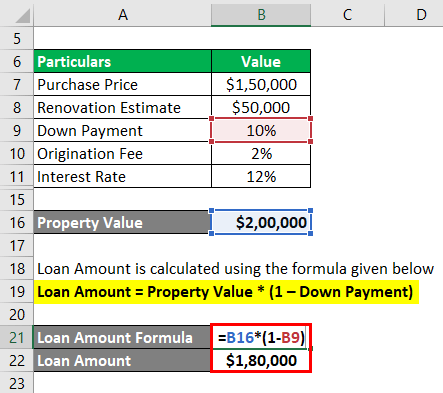

By comparison, rate of interest on tough money finances start at 6. 25% but can go much higher based on your place and also the residence's LTV. There are other costs to maintain in mind, as well. Tough money lending institutions frequently bill points on your financing, often described as origination charges. The factors cover the management costs of the funding.

Points are usually 2% to 3% of the loan amount. Three points on a $200,000 lending would be 3%, or $6,000.

4 Easy Facts About Hard Money Atlanta Described

You can expect to pay anywhere from $500 to $2,500 in underwriting charges. Some difficult cash loan providers also charge early repayment fines, as they make their cash off the interest fees you pay them. That implies if you repay the finance early, you may need to pay an additional cost, adding to the financing's cost.This implies you're more probable to be provided funding than if you requested a typical home loan with a questionable or slim credit score history. hard money atlanta. If you require money quickly for improvements to flip a residence for profit, a tough money loan can provide you the cash you require without the headache and paperwork of a standard mortgage.

It's an approach financiers use to get investments such as rental residential properties without utilizing a whole lot of their own assets, as well as hard money can be beneficial in these scenarios. Although difficult cash financings can be helpful genuine estate investors, they must be made use of with caution specifically if you're click to investigate a newbie to property investing.

If you default on your financing settlements with a hard cash lender, the effects can be serious. Some loans are directly ensured so it can harm your credit report.

An Unbiased View of Hard Money Atlanta

To discover a trusted lender, speak with relied on realty agents or mortgage brokers. They may have the ability to refer you to lending institutions they have actually dealt with in the past. Difficult money lending institutions additionally frequently go to investor meetings to make sure that can be an excellent place to get in touch with loan providers near you. hard money atlanta.Equity is the worth of the residential property minus what you still owe on the home mortgage. Like tough cash fundings, house equity financings are safeguarded debt, which means your residential property works as collateral. However, the underwriting for house equity fundings likewise takes your credit report and also income into account so they have a tendency to have lower rate of interest and longer payment durations.

When it pertains to moneying their next bargain, genuine estate investors and entrepreneurs are privy to numerous providing options essentially produced property. Each features particular demands to access, and if utilized appropriately, can be of massive benefit to capitalists. Among these loaning kinds is difficult cash loaning. hard money atlanta.

It can likewise be called an asset-based financing or a STABBL car loan (temporary find more asset-backed bridge lending) or a bridge funding. These are acquired from its characteristic temporary nature and the requirement for concrete, physical security, typically in the type of actual estate home.

The 25-Second Trick For Hard Money Atlanta

They are pertained to as temporary swing loan and the significant usage instance for difficult money fundings is in realty transactions. They are thought about a "difficult" cash financing due to the physical asset the property residential property called for to safeguard the financing. On the occasion that a consumer defaults on the loan, the lending institution gets the right to assume possession of the property in order to recoup the car loan sum.As a result, demands might vary substantially from loan provider to lending institution. If you are seeking a finance for the first time, the approval procedure can be relatively strict as well as you might be required to offer added details.

This is why they are mainly accessed by realty business owners who would commonly require rapid funding in order to not miss out on out on warm opportunities. Furthermore, the loan provider generally considers the value of the possession or home to be bought as opposed to the consumer's individual money background such as credit history or earnings.

A standard or small business loan may take up to 45 days to close while a hard money funding can be shut in 7 to 10 days, occasionally sooner. The benefit and speed that hard cash financings useful reference provide remain a major driving pressure for why genuine estate financiers select to use them.

Report this wiki page